A Comprehensive Guide to Section 179D Tax Deduction

Do you know if you own any commercial buildings or if you are an engineer, architect, special contractor, or equipment supplier who has worked on tax-exempt properties or government buildings?

The 179D Energy Efficient Commercial Buildings deduction may qualify you for a tax deduction of over $5.00 per square foot.

The 179D tax deduction is a perfect opportunity to transform your business by lowering tax burden while also contributing to economic growth. While this task deduction can help save several businesses thousands of dollars, it requires a thorough understanding.

This comprehensive guide will teach you about the 179D tax deduction, which includes:

What is the Section 179D tax deduction?

The eligible improvements changes made to the Section 179D tax deduction.

How to benefit from the modified Section 179D tax deduction rules.

What is the Section 179D Tax Deduction?

Section 179D tax deduction, also known as Energy-Efficient Commercial Buildings Deduction is a federal tax deduction that is made available to commercial building owners and companies working with government and tax-exempt buildings in the United States. The Section 179D tax deduction was revamped by the Inflation Reduction Act (IRA) of 2022 increasing the potential tax deduction and expanding eligibility to several building owners.

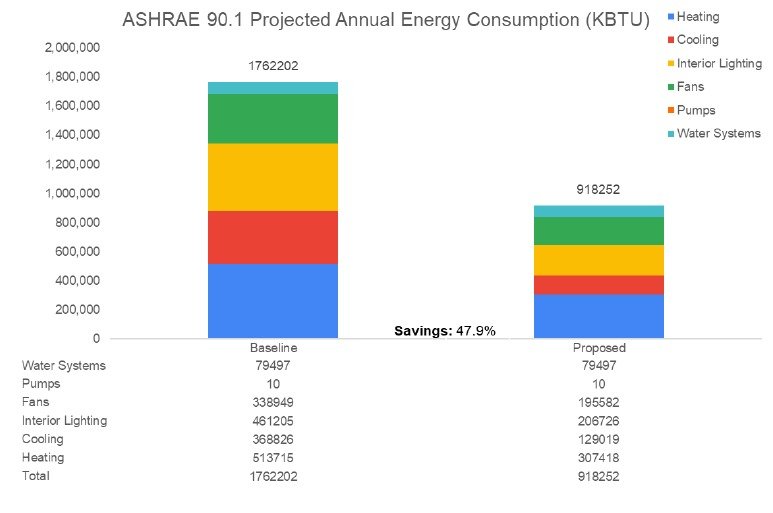

The general tax deduction rule expects energy-efficient buildings to save 25% on their total annual energy costs when compared to a recognized energy standard. Commercial building owners who invest in efficient energy improvements such as interior lighting, new HVAC systems, or building envelope systems, can benefit from this tax deduction.

Furthermore, engineers, architects, and contractors can take full advantage of the 179D deduction by designing interior lighting, HVAC systems, or building envelope systems for new renovation and construction projects on government or tax-exempt buildings. The deduction is intended to encourage the implementation of energy-efficient systems.

The Eligible Improvements

To significantly increase their tax deductions, business owners must have a thorough understanding of the eligibility criteria for 179D. New or improved building designs are expected to reduce energy consumption in accordance with the IRS guidelines. These efforts are expected to be focused on one or more of the following:

Interior lighting systems

Heating, cooling, ventilation, and hot water systems (HVAC systems)

Building envelop such as roofs, doors, walls, and windows

Changes Made to the Section 179D Tax Deduction

The following major changes made to the Section 179D Tax Deduction became effective after December 31, 2022:

1. Increased amounts of tax deduction: One of the most significant changes in the 179D is the increased potential of increased tax deduction. Previously, Section 179D allowed building owners to deduct up to $1.88 per square foot.

The new changes removed the partial deduction and introduced a new Applicable Dollar Value Model. There are two ways to claim tax deductions under this system:

Failure to meet prevailing wage and apprenticeship rules: for a project that does not meet prevailing wage and apprenticeship requirements, the tax deduction starts at over $0.50 per square foot. This increases by $0.02 for every percentage point above 25% reduction in energy and power costs (maximum of over $1.00 per square foot).

Satisfaction with prevailing wage and apprenticeship rules: for a project that meets the prevailing wage and apprenticeship standards, the tax deduction starts at over $2.50 per square foot and increases for each percentage point of energy savings over 25% (maximum of over $5.00 per square foot).

2. Reduced minimum expected energy savings: Previously, Section 179D required a project to have at least 50% savings of energy costs in comparison to the applicable reference standard. Currently, only 25% of reduced energy cost is expected to qualify for the deduction.

3. Prevailing wage and apprenticeship standards: According to the Notice by the Internal Revenue Service, January 29, 2023, was assigned as a key date, and projects that started before this data will not be expected to satisfy prevailing wage and apprenticeship hour standards.

4. Those who are eligible for Section 179D tax deduction: Originally, only building owners and taxpayers with depreciable property qualified for the tax deduction. Commercial building owners and companies that work with government and tax-exempt buildings can now take advantage of the deduction. This rule also applies to Alaska Native corporations and Indian tribal governments.

Benefits of the Modified Section 179D Tax Deduction

Changes to Section 179D are expected to have a long-term impact on energy-efficient building upgrades in the future. As a result of these modifications, 179D offers a wide range of benefits to building owners and design professionals, including:

Cost savings by reducing the energy system tax from $1.88 to over $5.00 per square foot

Long-term savings for commercial building owners as well as short-term savings for designers by investing in energy-efficient systems

Provision of more sustainable and accessible energy technology solutions

How to Benefit From the Modified Section 179D Tax Deduction Rules

As stated in the previous section, the modified Section 179D tax deduction rules provide a wide range of great cost-benefit opportunities that you can easily take advantage of. Here’s how you can fully take advantage of these new updates:

Completely understanding the efficient building upgrades established by the modified 179D

Work closely with architects, designers, and engineers to determine the best approach in claiming and allocating tax deduction

Consult with a tax advisor to improve the process

Stay informed by reviewing the technical requirements of the Section 179D tax deduction

Collect, organize, and store all technical records, construction details, and energy-efficient certifications to ensure compliance

Conclusion

The Section 1790D tax deduction is an excellent opportunity for commercial building owners as well as engineers, architects, and contractors to improve energy efficiency while lowering tax liabilities. Understanding and utilizing this tax deduction can increase savings by up to $5.00 per square foot. However, to take full advantage of this deduction, you should consult a tax advisor.

An energy analysis is required to determine whether your building qualifies for the Section 1790D tax deduction. At AG Engineering PLLC, we can help you perform a comprehensive energy analysis to determine eligibility to claim tax deductions for the energy-efficient systems in your building.